In our 2019 report, we document a whisky auction market continuing to grow. We also find out how the market moved away from Chile and even surpassed South Africa. Here is the first instalment of our Whiskystats Annual Report of 2019.

Yet another year went by, and it is time to wrap up the market movements we witnessed over the past twelve months. And the last year of the decade was an interesting one. On the one hand, the market continued its phenomenal growth as more and more bottles of whisky were traded in auctions. At the same time, though, the relative price performance of many market segments struggled. But first things first, so let’s look at the overall size of the market we track.

More and More

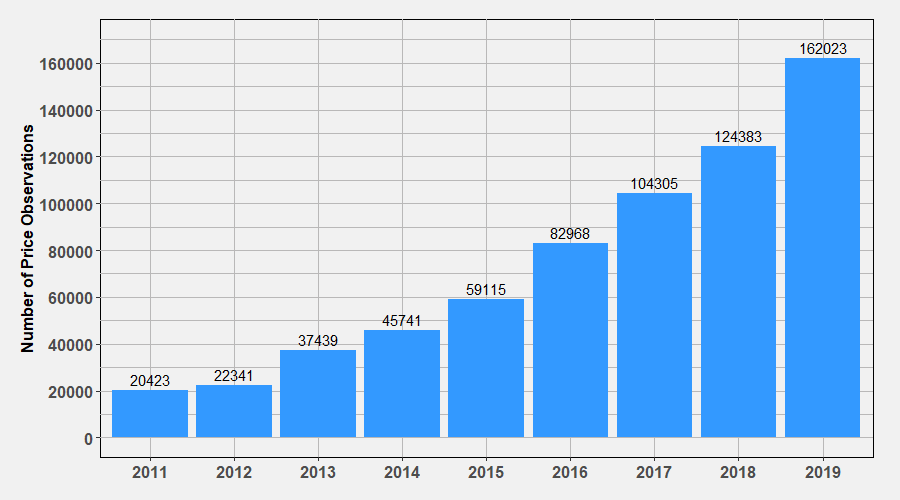

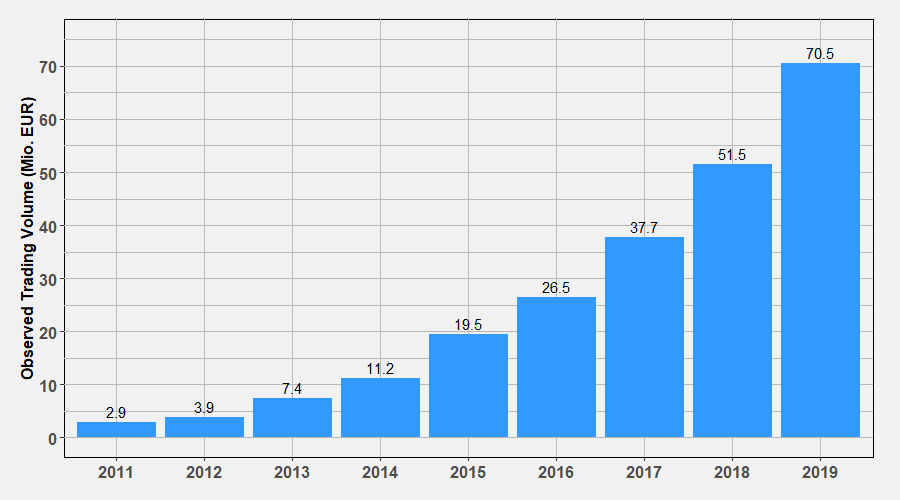

Guess what? 2019 was another record-breaking year regarding the number of whiskies traded on auctions. From January to December 2019, we observed no less than 162.000 bottles changing ownership. This is 30% more than in 2018 and the most significant increase in trades since 2016 when this number went up by 40% compared to 2015. To put this into perspective. At the beginning of the decade, in 2011, we saw little more than 20.000 bottles appearing in auctions. Now we count more than 630 thousand price observations in our whisky database. When we sum up the prices for all those trades, we get the total trading volume. In 2019, we observed that 70,5 million Euros were spent on whisky auctions. This equals a 37% increase compared to the 51,5 million in 2018. So on average, 435 Euros were paid per bottle. It sounds rather expensive, but the median price was only 150 Euros, so 50% of those traded bottles were cheaper than 150 Euros. This indicates that quite some costly trades pull the average price away from the median.

When we sum up the prices for all those trades, we get the total trading volume. In 2019, we observed that 70,5 million Euros were spent on whisky auctions. This equals a 37% increase compared to the 51,5 million in 2018. So on average, 435 Euros were paid per bottle. It sounds rather expensive, but the median price was only 150 Euros, so 50% of those traded bottles were cheaper than 150 Euros. This indicates that quite some costly trades pull the average price away from the median. The above figures suggest that we still don’t see any signs of the market growth slowing down, at least in sheer size. If the growth rate stays the same, 2020 could see more than 200 thousand bottles traded for more than 100 million Euros. The drifting apart from the mean and median price suggests that the price difference between the high-end bottles and the broad mass is also growing, so let’s look at that.

The above figures suggest that we still don’t see any signs of the market growth slowing down, at least in sheer size. If the growth rate stays the same, 2020 could see more than 200 thousand bottles traded for more than 100 million Euros. The drifting apart from the mean and median price suggests that the price difference between the high-end bottles and the broad mass is also growing, so let’s look at that.

Gini in a Bottle

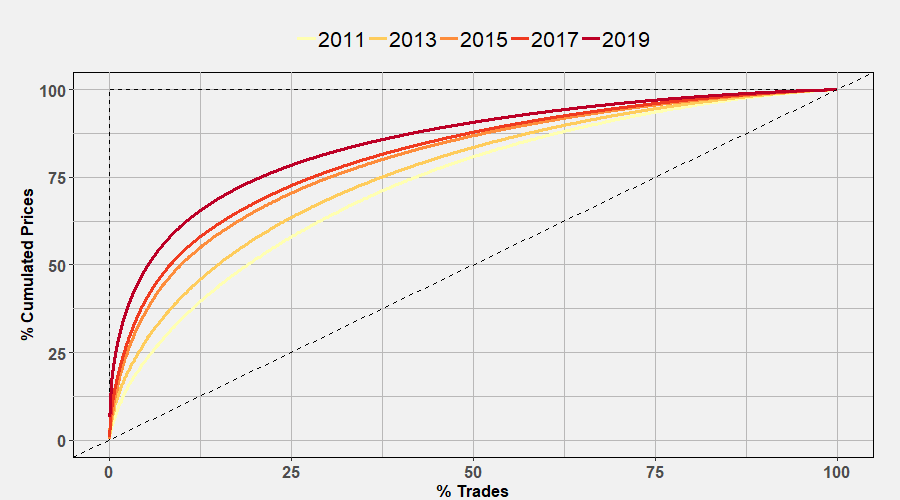

The so-called Gini coefficient measures inequality in income across a population. The higher the coefficient, the more wealth is concentrated in very few individuals. To adapt this measure to the whisky market, we sort the observed trades by their price and draw the line of cumulated prices. If there had been only one bottle which traded for 70,5 million Euros last year and all other bottles would have been given away for free, the curve would equal the left upper triangle. In contrast, if all the 162 thousand trades of 2019 had the same price, the curve would equal the diagonal. The share of the upper left triangle the actual curve covers is the Gini coefficient. In 2011, the curve covered 46,34% of the upper left triangle. According to the World Bank, this equals the latest Gini coefficient of Chile. So the inequality in price difference in the whisky auction market was about the same as the inequality in income in Chile back in 2017. In the chart above, we see that the disparity in the whisky market grew over time. In 2015 the coefficient reached 60%, and for 2019 we calculated a Gini coefficient of 68,64%. So now, the inequality in prices even surpassed South Africa’s income inequality, which was at 63% and among the highest worldwide.

In 2011, the curve covered 46,34% of the upper left triangle. According to the World Bank, this equals the latest Gini coefficient of Chile. So the inequality in price difference in the whisky auction market was about the same as the inequality in income in Chile back in 2017. In the chart above, we see that the disparity in the whisky market grew over time. In 2015 the coefficient reached 60%, and for 2019 we calculated a Gini coefficient of 68,64%. So now, the inequality in prices even surpassed South Africa’s income inequality, which was at 63% and among the highest worldwide.

Median Movements

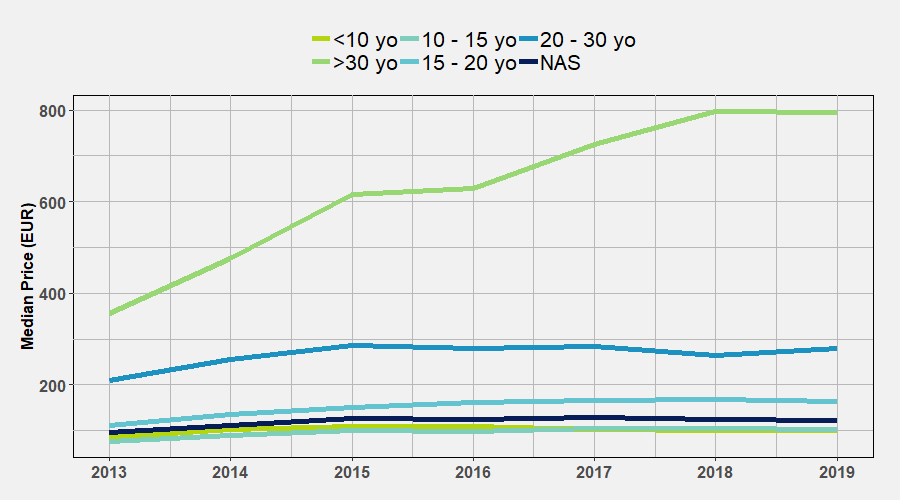

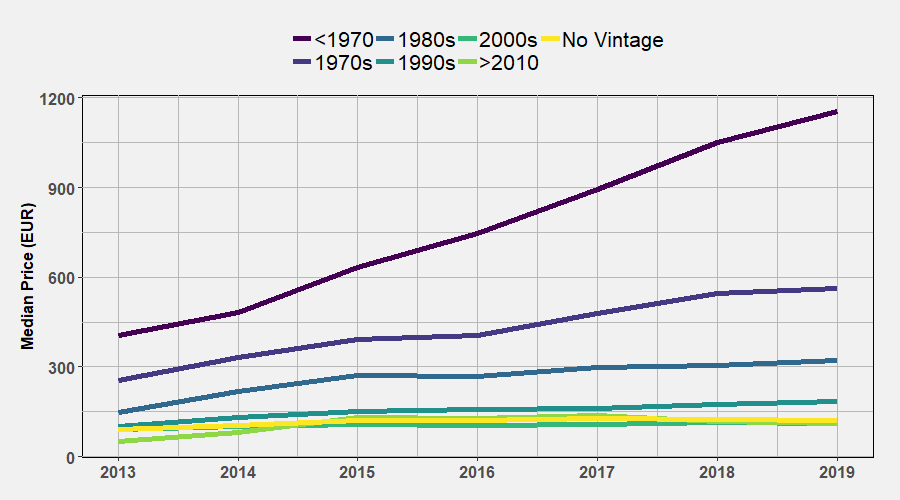

We now slowly turn our attention away from the bold mass of trades and towards relative price movements. Like in our 2018 reports, we first segment the market by the labelled age of the whiskies. We then calculate the median price per calendar year for each of these age clusters. Obviously the prices strongly depend on the time of maturation, which is apparent by the different levels the below curves live on. In 2018, half of the 20yo to 30yo whiskies traded for less than 265 Euros. In 2019 this number increased to 280 Euros. But for all other age groups, including the 30+yo, this median price did not change or slightly decrease in 2019. We repeat the same procedure but now group the traded whiskies by their vintage. In contrast to the above age clusters, we now see significant increases in the median prices. In 2018, 50% of the pre-1970 vintages sold for 1.050 Euros or fewer. In 2019, it was 1.150 Euros which equals an increase of 9,5%. Median prices for 1970s vintages increased by roughly 3% and the 1990s vintages by 5,7%. The younger decades more or less stayed the same. This further indicates what we have seen above, the drifting apart from the very collectable premium whiskies and the mass of bottles available on auctions.

We repeat the same procedure but now group the traded whiskies by their vintage. In contrast to the above age clusters, we now see significant increases in the median prices. In 2018, 50% of the pre-1970 vintages sold for 1.050 Euros or fewer. In 2019, it was 1.150 Euros which equals an increase of 9,5%. Median prices for 1970s vintages increased by roughly 3% and the 1990s vintages by 5,7%. The younger decades more or less stayed the same. This further indicates what we have seen above, the drifting apart from the very collectable premium whiskies and the mass of bottles available on auctions.

Obviously, those changes in median prices could be caused by a different set of actual bottles that have been auctioned. That is why we use our Whiskystats indices, which summarize the actual changes in the pricing of all whiskies. So in the upcoming instalment of our 2019 Annual Report, we will take a look at how the market performed in the way that matters for you as a whisky collector. Stay tuned.

Disclaimer: the whisky market insights presented in this article are based on the Whiskystats database at the time of publication. Whiskystats is constantly adding new data, and therefore some charts and figures may not match after initial publication.