The second half of 2019 saw many segments of the secondary whisky market struggling. Hanyu dominates the scene while Japanese whiskies continue to outperform their Scottish counterparts. Here is the second part of our Whiskystats Annual Report of 2019.

In the first part of our 2019 Annual Report, we saw that the whisky auction market grew strongly last year. The number of traded bottles and the total money spent on auctions reached new records. But the market size is only one side of the coin, the other being the price changes of the single bottles. To summarise the relative price changes of different market segments, we use our Whiskystats Indices.

Major Market Indices

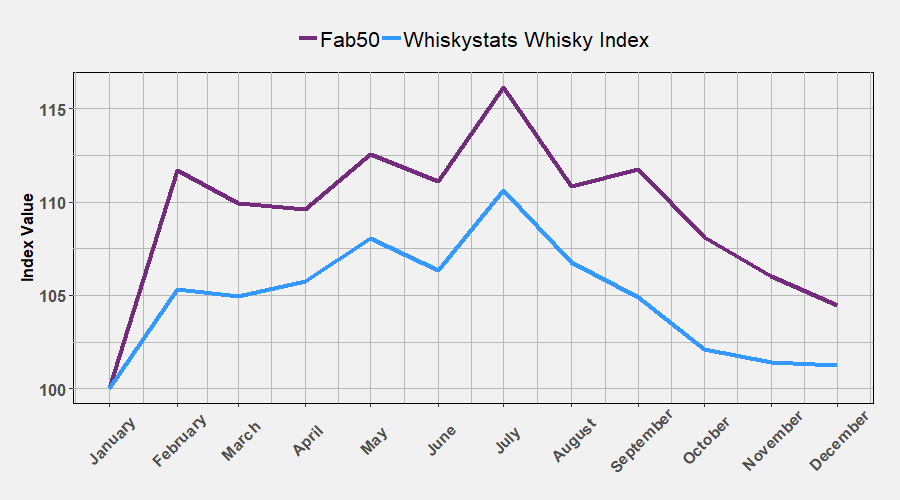

The Whiskystats Whisky Index (WWI) is our major market index. Each month it summarizes the change in value of the historically 500 most traded whiskies. In the chart below, we visualized the index movements of the WWI throughout 2019. The year was off to a good start. In the February round of auctions alone, the respective 500 bottles gained more than 5% in value. By July 2019, the WWI climbed by more than 10% and reached a new all-time peak of almost 218 index points. But then things changed and what followed was the most extended period of consecutive losses we have ever witnessed for this index. From July to December 2019, WWI lost 8,5%, extinguishing all the gains from the year’s first half.

The second major market indicator we tend to use is our Fabulous Fifty collection. The fifty bottles represent some of the most iconic releases from each major whisky region. Our Fab50 index simply reflects the relative price changes of this collection. From the graph above, it seems like these fifty bottles are a good reflection of the overall collectors market. The WWI and the Fab50 have a strong correlation, and pretty much everything we observed for the WWI is also true for the Fab50. Also, the WWI and Fab50 stopped their downward movements in January 2020.

The second major market indicator we tend to use is our Fabulous Fifty collection. The fifty bottles represent some of the most iconic releases from each major whisky region. Our Fab50 index simply reflects the relative price changes of this collection. From the graph above, it seems like these fifty bottles are a good reflection of the overall collectors market. The WWI and the Fab50 have a strong correlation, and pretty much everything we observed for the WWI is also true for the Fab50. Also, the WWI and Fab50 stopped their downward movements in January 2020.

Region Indices

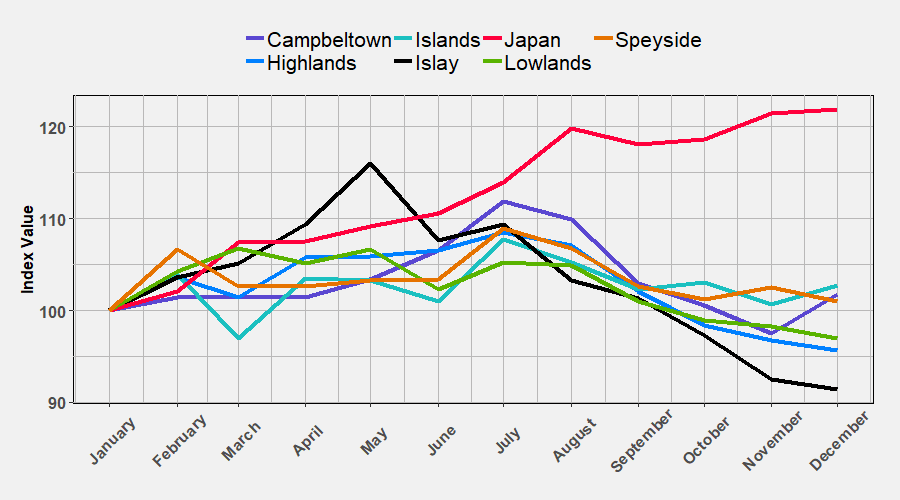

To drill down these overall market movements, we now compare the indices of the major whisky regions. These are the six traditional scotch whisky regions and secondary market favorite Japan. Again all indices were scaled to 100 in January 2019 to ease the comparison of the annual performance. Japan outperformed all Scotch regions by miles. When all the regions lost significantly in August, the 100 most traded Japanese releases gained more than 5% in value. Our Japan whisky index closes the year by almost 22% in the green. On the other side of the spectrum, we also find a secondary market ever green, the whiskies from the Isle of Islay. Our Islay index gained 25% from November 2018 to May 2019. But in June, the Feis Ile came to an abrupt halt. Within a single auction round, the 100 most traded Islay releases lost more than 7% and continued to do so through the rest of 2019. By December, the Islay index dropped below its November 2018 value. All the other scotch regions experienced similar but not so pronounced index movements last year. After hefty losses in the second half, only the Islands, Speyside and Campbeltown close the year with a slight index gain.

On the other side of the spectrum, we also find a secondary market ever green, the whiskies from the Isle of Islay. Our Islay index gained 25% from November 2018 to May 2019. But in June, the Feis Ile came to an abrupt halt. Within a single auction round, the 100 most traded Islay releases lost more than 7% and continued to do so through the rest of 2019. By December, the Islay index dropped below its November 2018 value. All the other scotch regions experienced similar but not so pronounced index movements last year. After hefty losses in the second half, only the Islands, Speyside and Campbeltown close the year with a slight index gain.

Distillery Performance

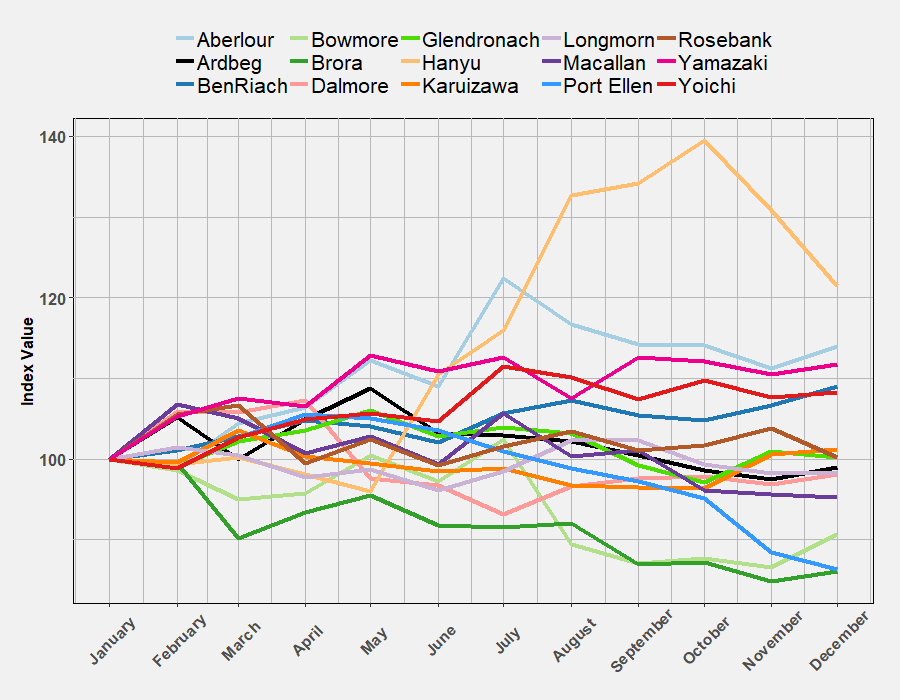

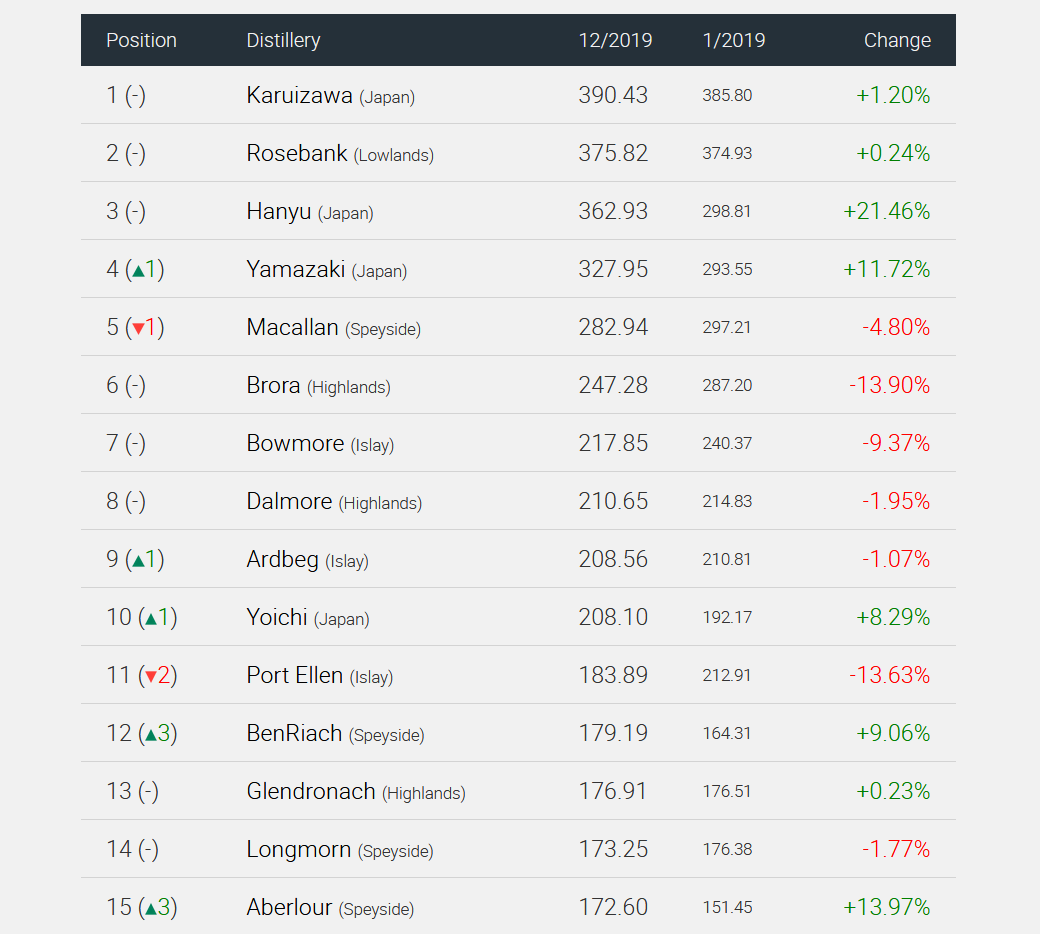

The next obvious step is to look at the performance of the different distilleries. For this we restrict our attention to the top fifteen of our distillery ranking as of December 2019. These indices again depict the relative price changes of the respective most traded bottles month by month. By far the top performing distillery of 2019 is Hanyu. Although our Hanyu index lost significantly in the last quarter of the year, it closes with a plus of more than 21%! As we have seen throughout the year in our Monthly Price Updates, this index movements were mostly driven by the Hanyu Playing Card series. By the way, in January 2020 the most traded Hanyu bottlings again gained almost 6% in value. For some of the most iconic scotch whisky brands, 2019 was not enjoyable, at least for the collectors. Our Macallan index lost almost 5% throughout the year. Since the peak of the Macallan Price Rally in September 2018, Macallan lost four places in our ranking and a total of almost 80 index points. The indices of the now silent Brora and Port Ellen distilleries lost 14% in 2019. Port Ellen thereby even dropped out of the Top 10 in our ranking. Prices for the most traded Bowmore releases soared from 2016 to mid-2018. However, in 2019 our Bowmore index lost 9,4%, seeing the distillery losing its place in the very top tiers of collectable single malt distilleries.

For some of the most iconic scotch whisky brands, 2019 was not enjoyable, at least for the collectors. Our Macallan index lost almost 5% throughout the year. Since the peak of the Macallan Price Rally in September 2018, Macallan lost four places in our ranking and a total of almost 80 index points. The indices of the now silent Brora and Port Ellen distilleries lost 14% in 2019. Port Ellen thereby even dropped out of the Top 10 in our ranking. Prices for the most traded Bowmore releases soared from 2016 to mid-2018. However, in 2019 our Bowmore index lost 9,4%, seeing the distillery losing its place in the very top tiers of collectable single malt distilleries.

But there were also distilleries which pleased collectors in 2019. Our Linkwood index gained 35% from March to June. Overall, this Speyside distillery closed the year with a plus of 18,3%. Another winner of 2019 is Aberlour. An annual index gain of 14% brought the distillery up three places in our ranking and into the top fifteen. In January 2020, Aberlour even climbed to the 12th overall place. Yamazaki gained 11,7% and thereby increased the distance to fifth-placed Macallan. The Highland distillery Ben Nevis also made solid gains with an overall plus of 14%. And finally, Tullibardine gained 12,4%. Our Tullibardine index stands at 161 points which equals 19th place among all single malt distilleries.

Value Clusters

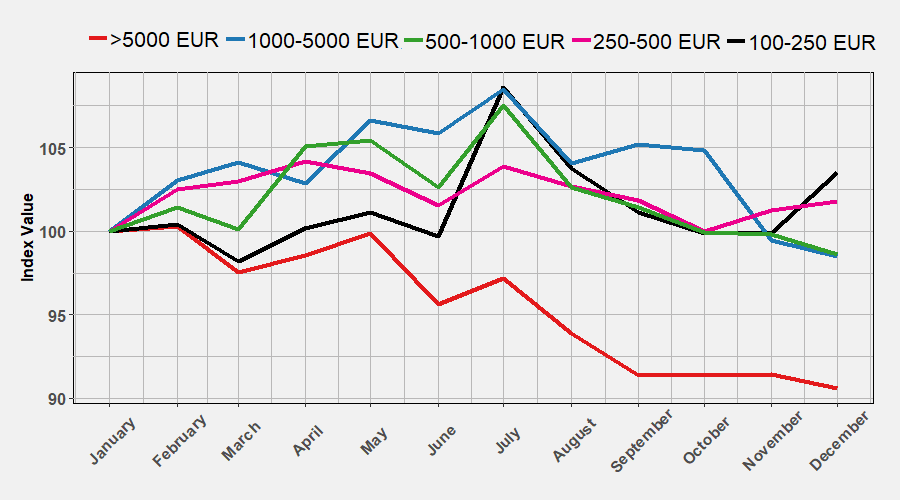

Finally, we want to find out how the different price segments of the market performed. We grouped all bottles by their mean trading price in 2018. If a whisky was not traded in 2018, it would not affect this analysis. We then calculated an index (in the same way we did for the regions and distilleries) for each of these clusters. This will tell us how the different value segments performed in 2019. Surprisingly, the index for the most expensive group (those with an average 2018 price of more than 5.000 Euros) performed worst. This cluster of bottles lost almost 10%, far more than any of the other value clusters we built. The most stable performance was observed for those whiskies, which traded for 250 to 500 Euros on average in 2018. Over the observation period, the index of these whiskies gained 2% and was the least volatile. The cheapest cluster in this analysis (100 to 250 Euros) had the best performance of around 3%. We noticed a massive jump in July, as we did for all the clusters.

The most stable performance was observed for those whiskies, which traded for 250 to 500 Euros on average in 2018. Over the observation period, the index of these whiskies gained 2% and was the least volatile. The cheapest cluster in this analysis (100 to 250 Euros) had the best performance of around 3%. We noticed a massive jump in July, as we did for all the clusters.

So 2019 started as one would have expected based on the past years. In the first six months, pretty much all market segments gained solidly. Then, the second half turned things upside down completely. The months from July to December 2019 turned out to be the most prolonged period of decline we have ever witnessed. In January 2020, this downward movement stopped, at least for now. We are eager to learn how the secondary whisky market will perform in 2020.

Disclaimer: the whisky market insights presented in this article are based on the Whiskystats database at the time of publication. Whiskystats is constantly adding new data, and therefore some charts and figures may not match after initial publication.