In the second part of our 2016 recap we take a look at some major market movements. Japanese whiskies stumbled to some value gain this year, while the price increases of one Speyside distillery top them all.

The first part of our annual report was focused on the secondary whisky market as a whole. We saw that never before were more single malt whiskies traded than in 2016. Consequently also the involved cash volume reached new heights with more than 16 Million Euros transferred. So what we did was that we compared the total number of trades and the aggregated prices. Now we want to go a step further and analyse how the prices changed over the last 12 months.

Major Market Movement

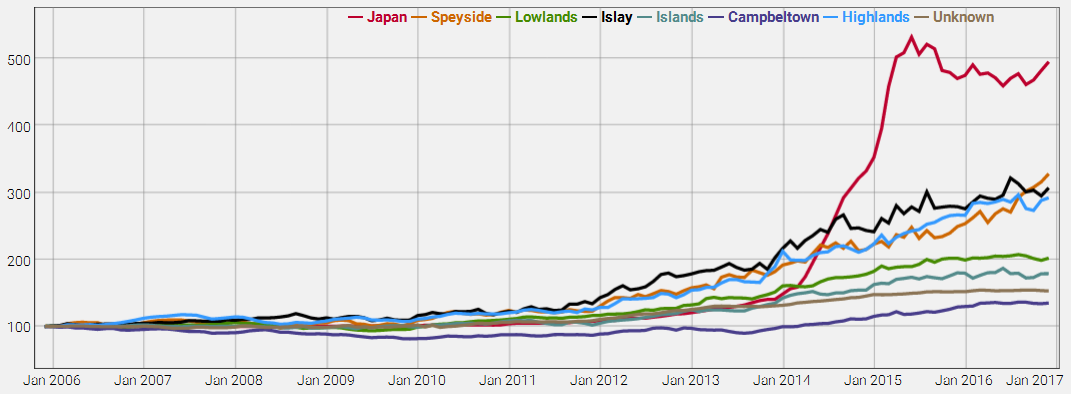

The first thing that we want to have a look at is a comparison of the seven different whisky producing regions we have in our whisky database. For this purpose we compare our Whiskystats Region Indices. This indices represent the historic change in value of the 100 most traded whiskies of each region. One year ago this comparison divided these regions into three clusters. On top there was Japan with an index value of almost 500, which means that the 100 included bottles almost quintupled their value since January 2006. On the places followed Islay, the Highlands and Speyside with each little less than 300 index points. Then the Lowlands and the Islands followed as well as bottom placed Campbeltown. This year, we see that Speyside overtook the Highlands and Islay and resides on the second place of our region ranking. The Speyside index climbed from 253 to 328 index points, which equals an almost 30% increase in value of the 100 included bottles. The Islay index too broke through the 300 point threshold by gaining 10%. A closer look at our Japan Index reveals that it lost 3% from January to June but gained 4% over the whole year of 2016.

This year, we see that Speyside overtook the Highlands and Islay and resides on the second place of our region ranking. The Speyside index climbed from 253 to 328 index points, which equals an almost 30% increase in value of the 100 included bottles. The Islay index too broke through the 300 point threshold by gaining 10%. A closer look at our Japan Index reveals that it lost 3% from January to June but gained 4% over the whole year of 2016.

Distillery Comparison in 2016

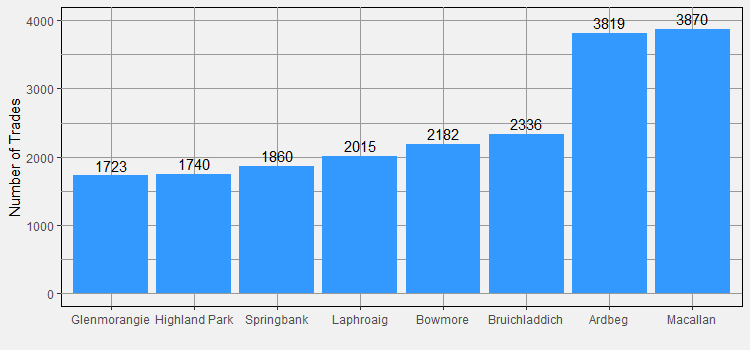

After we compared the performance of the regions, we now turn our attention to the distilleries. For those of you who follow our Monthly Price Updates it is probably of no surprise that Macallan and Ardbeg are the two most traded distilleries of 2016. Over the last twelve months we observed 3.870 trades for Macallan and 3.819 trades for Ardbeg alone! Third placed Bruichladdich stands at 2.336 bottles traded. The Top 8 of the most traded distilleries of 2016 is completed by Bowmore, Laphroaig, Springbank, Highland Park and Glenmorangie. In our database we currently track whiskies from 144 different distilleries. For 129 of these distilleries we have enough price observations to compute a distillery index. These indices again describe the historic value development of the respective most traded whiskies. We can use this indices to rank the distilleries, which we do in our monthly updated Distillery Ranking. There you see that the top places are taken by Hanyu, Karuizawa and Macallan. We now restrict our attention to the eight most traded distilleries from above by directly comparing their indices.

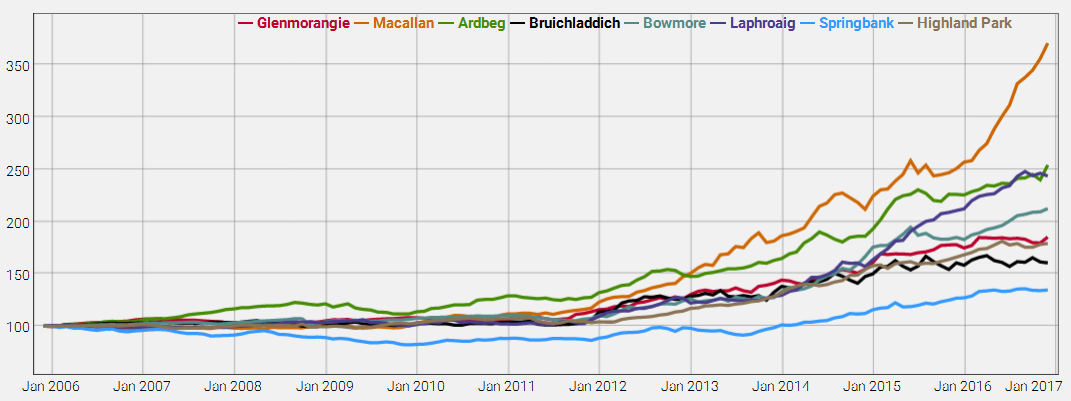

In our database we currently track whiskies from 144 different distilleries. For 129 of these distilleries we have enough price observations to compute a distillery index. These indices again describe the historic value development of the respective most traded whiskies. We can use this indices to rank the distilleries, which we do in our monthly updated Distillery Ranking. There you see that the top places are taken by Hanyu, Karuizawa and Macallan. We now restrict our attention to the eight most traded distilleries from above by directly comparing their indices. What strikes our eye first is the massive value increase of the Macallan distillery. For the 100 included whiskies we have 4.714 price observations. These price observations show that this virtual Macallan collection experienced an unbelievable 44% (!) increase in value during 2016. The index now stands at 370 points. This also explains the outstanding performance of the Speyside index, which is of course dominated by Macallan. Another winner of 2016 is Laphroaig. The 100 included bottles gained 14% which is impressive but much less than the 30% in 2015. With this performance Laphroaig almost overtook Ardbeg which now stands at 250 index points. Also worth mentioning in this context is the Bowmore distillery. The corresponding index climbed by 16% to now 211 index points.

What strikes our eye first is the massive value increase of the Macallan distillery. For the 100 included whiskies we have 4.714 price observations. These price observations show that this virtual Macallan collection experienced an unbelievable 44% (!) increase in value during 2016. The index now stands at 370 points. This also explains the outstanding performance of the Speyside index, which is of course dominated by Macallan. Another winner of 2016 is Laphroaig. The 100 included bottles gained 14% which is impressive but much less than the 30% in 2015. With this performance Laphroaig almost overtook Ardbeg which now stands at 250 index points. Also worth mentioning in this context is the Bowmore distillery. The corresponding index climbed by 16% to now 211 index points.

Age Matters (even more)

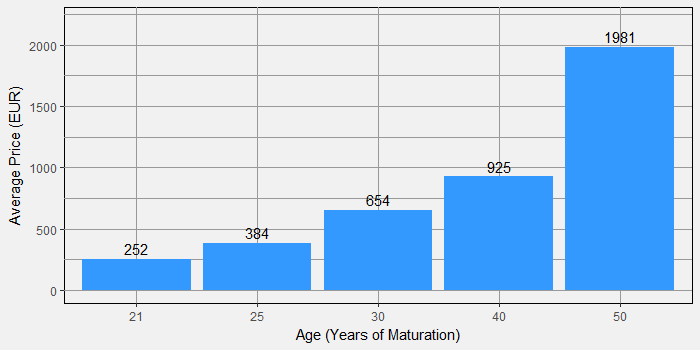

Almost exactly one year ago we compared our database to the results of the Rare Whisky 101 Report in our Rare Whisky 101 – Whiskystats Face-Off. Among other things, we analysed the influence that the age-statement has on the prices. For this purpose simply the average price for 21yo, 25yo, 30yo, 40yo and 50yo single malt bottlings was calculated. The (unsurprising) result was that these average prices dramatically increased the older the bottlings got. We now simply repeated this analysis to find out how this pattern changed during the year of 2016. From this updated results we see that the average price for 21yo stayed pretty much the same. But when we look at 30yo and especially 40yo we observe an increased average price per bottle traded. It seems like high age-statements continue to drive prices which is probably unsurprising considering the trend to No-Age-Statement whiskies on the primary market.

From this updated results we see that the average price for 21yo stayed pretty much the same. But when we look at 30yo and especially 40yo we observe an increased average price per bottle traded. It seems like high age-statements continue to drive prices which is probably unsurprising considering the trend to No-Age-Statement whiskies on the primary market.

Overall we get the impression that the secondary whisky market continues to grow and attracts more participants. For us this means that we can expect a lot of new price observations during the next year which is great. More data means more possibilities for new analysing methods, which we hope to deliver soon. We are eager to see what the major market movements of 2017 will be!