Auction prices for most whiskies remained almost unchanged. Aberlour and Talisker stand out with significant value gains, while Dalmore and Glenfiddich continue to lose market value. Here is the Whiskystats Price Update for March 2024.

In the March auction round, buyers and sellers exchanged over 28 thousand bottles of 13.5 thousand unique whisky releases. Despite this large number of trades, the market values of most whiskies remained relatively stable. All of the major market indices moved sideways, including the Whiskystats Whisky Index (-0.1%), Original Bottlings (-0.4%), Independent Bottlings (+0.3%), Scotch Whisky (-0.1%), and Japanese Whisky (-0.3%).

Aberlour and Talisker

Although the overall market seemed to stabilize during the past month, some brands stood apart. Aberlour and Talisker, for instance, saw the most significant value gains among the Scotch whisky brands. Auction prices for the historically most traded Aberlour whiskies increased by 5.9% in March. Since September 2022, the Aberlour auction price index has climbed by almost 15% and has now arrived at a level last seen in April 2022, when the overall auction market peaked.

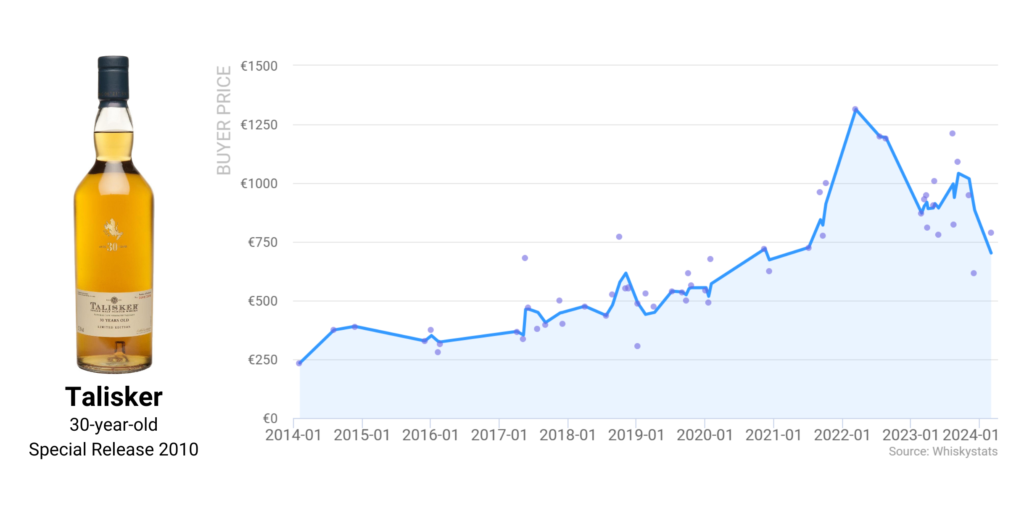

In regards to Talisker, the 6.3% index gain in March came after almost two years of severe value losses for the brand. Auction prices for Talisker peaked in May 2022 and fell by almost 27% until February 2024. The below displayed Talisker 30yo Special Release 2010 perfectly mirrors this price pattern: auction buyer prices reached €1.300 in Spring 2022, then dropped to €600 in late 2023 before jumping back last month to €800. Other examples include the Talisker 1955 Secret Still 1.1, which sold for €3.400 again, and the Talisker 1978 from R. W. Duthie, which fetched a new record price of €5.000.

Among the main drivers of the Aberlour auction price index is the A’bunadh range. The around 80 batches of this series are frequently traded at auctions, with some of the earlier releases experiencing significant value gains. The Aberlour A’bunadh (early Batches, no number) just sold for €500. Both Batch #30 and Batch #57 also realized all-time records at €385 and €130, respectively, while Batch #29 jumped from €170 in September 2023 to €280.

Dalmore and Glenfiddich

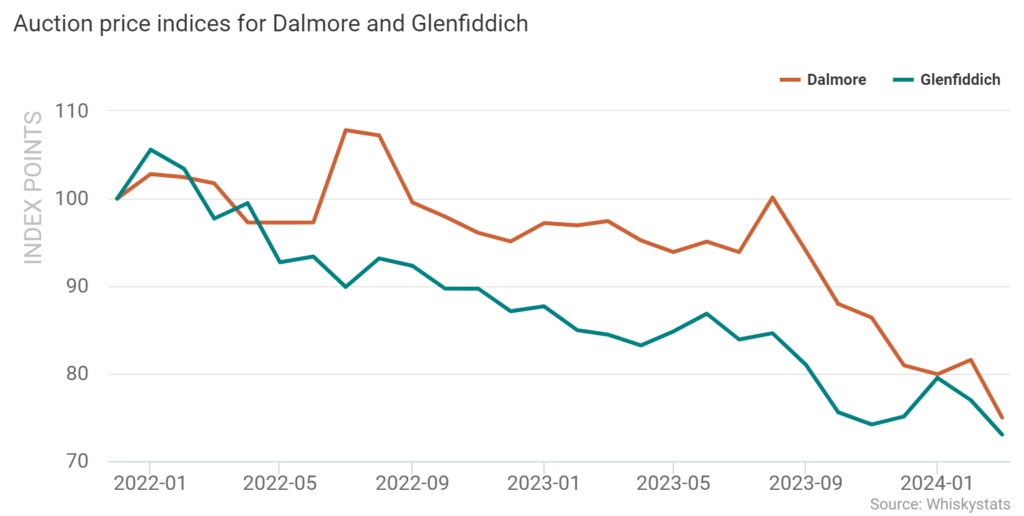

On the value-losing end of the March brand index ranking, we find Dalmore (-8%) and Glenfiddich (-5%). Auction prices for both of these brands never really gained much compared to other brands, and by March 2024, the associated indices were still trapped in a downward trend. The Dalmore index has now fallen back to its level from August 2014. For Glenfiddich, the respective index is now at its lowest point ever since it started in January 2013.

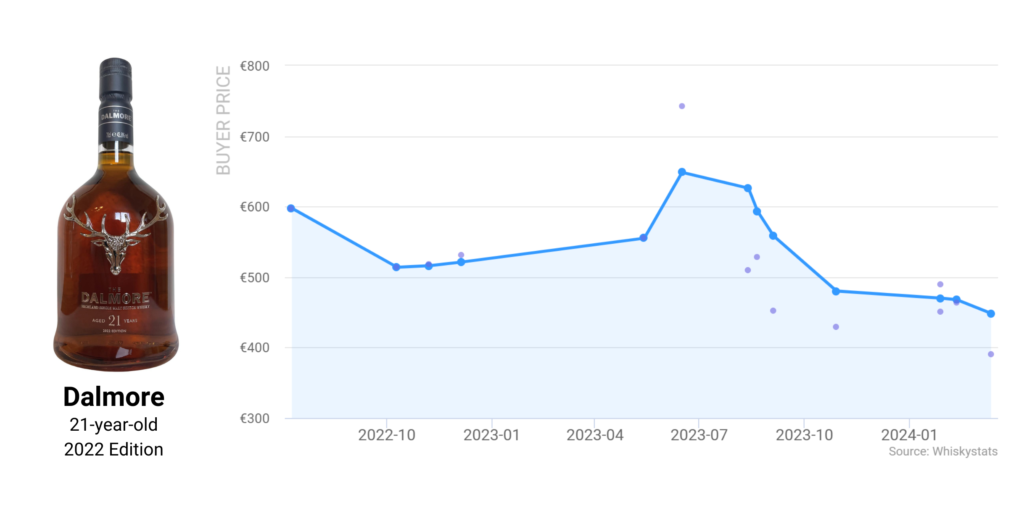

One example of the Dalmore auction price trend is the Dalmore 21yo 2022 Edition. The first auction buyer prices from July 2022 came in at around €600. All subsequent trades, with one exception, could not confirm that level, with the latest sale dropping below €400. To cite another example, the Dalmore 12yo Mackenzie Brothers regularly traded for more than €1,000 in 2022. However, in February 2024, buyer prices dropped to €750, and in March, they fell even further to €560.

Of course, there are also Glenfiddich releases that previously gained value at auctions. The Glenfiddich 1977 Vintage Reserve was first seen on auctions in July 2009, when it sold for €480. Then, buyer prices climbed to €2,275 in January 2021 before dropping to around €1,600 in 2022 and 2023 and now €1,000 in March 2024. The same is true for the Glenfiddich 1973 Vintage Reserve, which started at €240, peaked at €3,000, and now dropped to €1,230.

Disclaimer: The whisky market insights presented in this article are based on the Whiskystats database at the time of publication. Whiskystats is constantly adding new data; therefore, some charts and figures may not match after initial publication.