All of our major indices lost ground in the September round of auctions, although Hanyu, Yamazaki and Macallan realized gains. We also identified some inefficiencies in the secondary whisky market. Here is the price update for September 2019.

A whopping fifteen thousand new price observations found their way into our database this month. No less than eight thousand different releases experienced a price change. Cadenhead is once again the most traded independent bottler of them all. This is the fourth consecutive time that the oldest Scottish independent bottler could claim this position. At the same time, the most traded Cadenhead whiskies lost 3,7% in value last month.

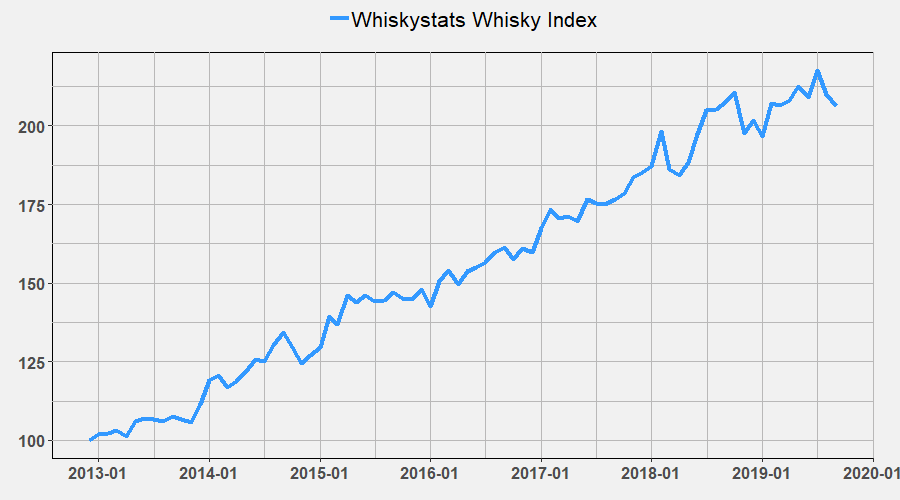

The same is true for the overall market. Our Whiskystats Whisky Index (WWI), which summarizes the changes in the value of the 500 most traded whiskies each month, lost 1,2%. Since its peak in July, the WWI has lost more than 5% to now stand at 206 index points. To drill down and discover the origins of this decrease, let’s look at the different whisky regions.

The same is true for the overall market. Our Whiskystats Whisky Index (WWI), which summarizes the changes in the value of the 500 most traded whiskies each month, lost 1,2%. Since its peak in July, the WWI has lost more than 5% to now stand at 206 index points. To drill down and discover the origins of this decrease, let’s look at the different whisky regions.

Collective Decrease

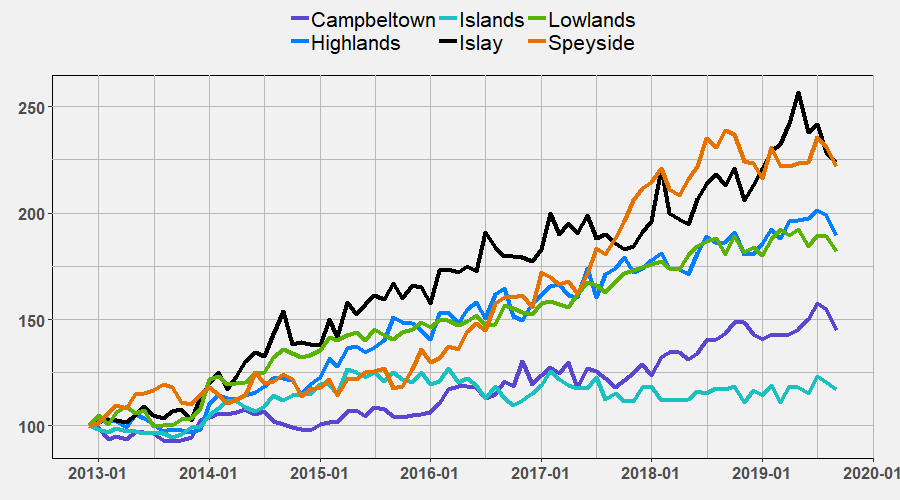

Our region indices are compared in the graph below. This month, all regions were responsible for the value loss. Even the below not included Japanese whiskies lost value for the first time in 2019. A decrease of 1,5% brought our Japan index to 652 points. The historically most traded Islay whiskies fell by 1,8%, Speyside by 3,9%, the Highlands by 4,7% and Campbeltown even by 6,4%. The next step is to have a look at our distillery indices. Out of the top 10 distilleries, Hanyu (+1,1%), Yamazaki (+4,7%), Macallan (+0.7%) and Dalmore (+1%) all gained points. We observed the biggest losses for Brora (-5,5%), Rosebank (-2,3%) and Bowmore (-2,7%). Further down the list, Springbank, Laphroaig and Glendronach lost significantly. So as it turns out, the secondary whisky market paused its value growth as a whole, at least in September 2019. One possible explanation for this could be the high number of bottles on offer this month. This year, we saw more bottles being auctioned in March.

The next step is to have a look at our distillery indices. Out of the top 10 distilleries, Hanyu (+1,1%), Yamazaki (+4,7%), Macallan (+0.7%) and Dalmore (+1%) all gained points. We observed the biggest losses for Brora (-5,5%), Rosebank (-2,3%) and Bowmore (-2,7%). Further down the list, Springbank, Laphroaig and Glendronach lost significantly. So as it turns out, the secondary whisky market paused its value growth as a whole, at least in September 2019. One possible explanation for this could be the high number of bottles on offer this month. This year, we saw more bottles being auctioned in March.

Market Inefficiency

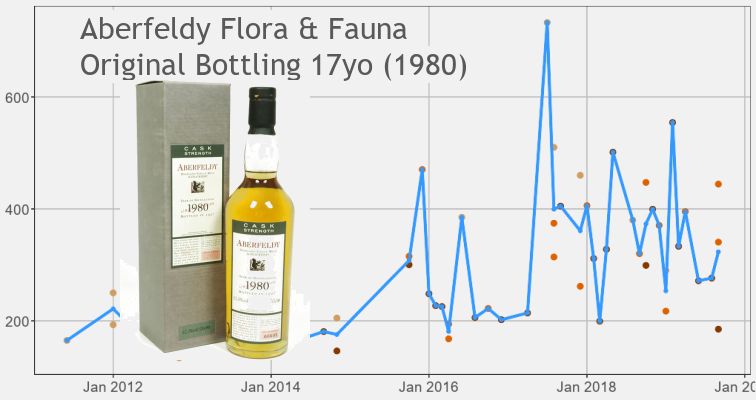

Finally, we want to point out some exciting price observations made this month. For us, it seems like the market cannot get its head around what these bottles should be worth. So prices bounce back and forth depending on the auction platform. One example is the Aberfeldy 17yo Flora & Fauna release from 1997. In September 2019, we observed one of these bottles traded at WhiskyAuctioneer.com for roughly 444 Euros. At the same time, at ScotchWhiskyAuction.com, the same bottle fetched only 185 Euros. If we further look at the price history of this release displayed in the graph below, we notice huge differences there. In July 2017, this Aberfeldy reached 733 Euros at WhiskyAuction.com.

And there are undoubtedly other examples of such market inefficiencies. Take the Johnnie Walker Private Collection from 2014. This month this blend was sold for almost 1.000 Euros at ScotchWhiskyAuction.com but only achieved 340 Euros at WhiskyAuction.com. Or the Bruichladdich Black Art 5.1 for which the prices this month vary between 83 at 211 Euros. And then there is the Glenfarclas Limited Rare Bottling No.18. This Speyside single malt is consistently trading around 180 Euros. But in August and September 2019, we suddenly find two price observations at 625 and 420 Euros. It seems like we still have a long way to go to bring more transparency to the secondary whisky market.

To avoid such mispricing, track the value of your whiskies by creating your personal collection on Whiskystats.

Disclaimer: the whisky market insights presented in this article are based on the Whiskystats database at the time of publication. Whiskystats is constantly adding new data, and therefore some charts and figures may not match after initial publication.